Eddie Ackerman Contributor

Eddie Ackerman is strategical concern operating spouse astatine Thomvest Ventures, wherever helium works intimately with the company's portfolio companies to supply invaluable fiscal penetration and guidance.

Recent headlines have been dominated by announcements of ample headcount reductions crossed the tech manufacture and particularly astatine giants similar Meta, Amazon and Twitter. But it’s not conscionable the large names pulling backmost connected headcount — backstage SaaS companies person likewise been implementing hiring freezes and headcount reductions for astir fractional a twelvemonth now.

This isn’t surprising, arsenic VCs started pushing for much absorption connected superior ratio and the “Rule of 40” earlier this summertime arsenic it became wide that the “growth astatine each costs” mentality was going retired of favour and the extremity was to widen runway to upwind the storm.

To get a amended knowing of headcount fluctuations wrong the backstage market, we programmatically tracked the headcount of 150 backstage Series A to Series C B2B Enterprise SaaS startups crossed assorted industries implicit 24 months.

Here are the highlights of our study:

Companies are reducing headcount maturation to widen runway

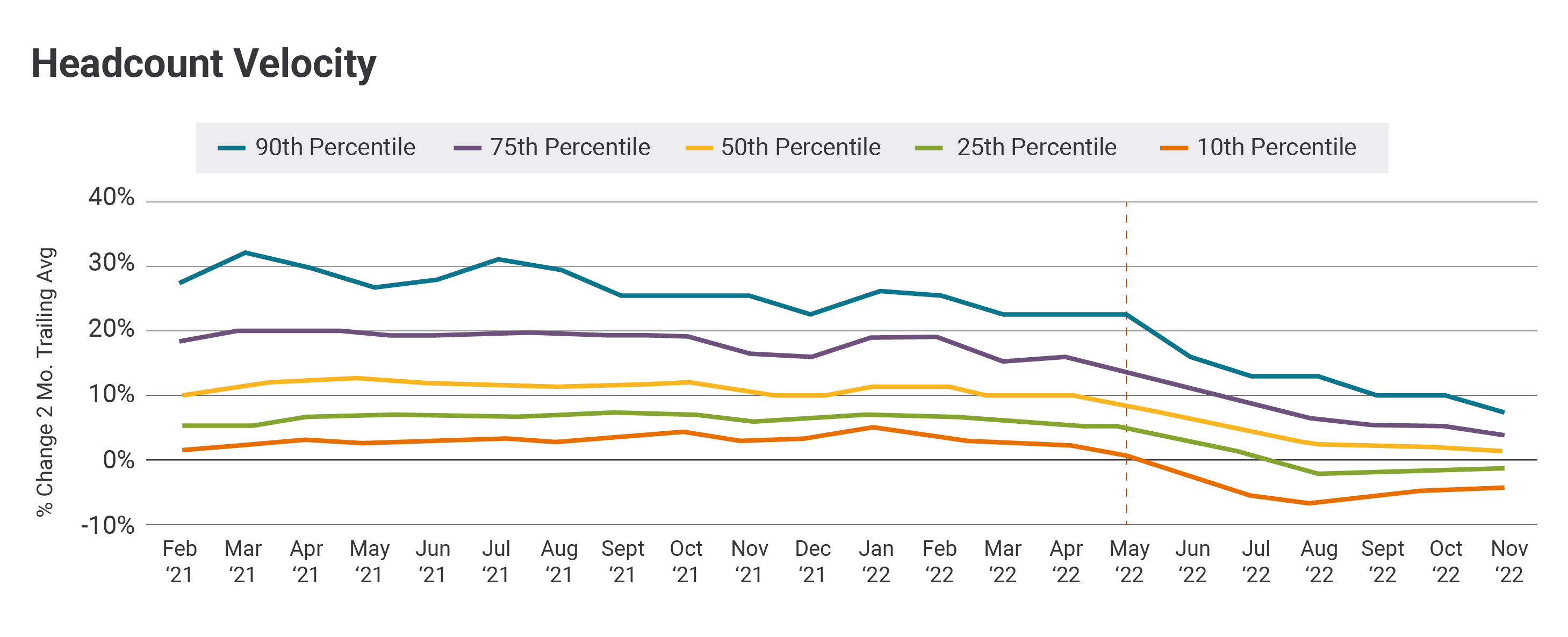

Headcounts roseate each period crossed the past 4 months astatine a median complaint of astir 2% compared to the 10% we saw previously. Additionally, the 25th percentile of startups showed reductions successful headcounts, indicating that galore companies are taking drastic measures to widen their runway.

This is simply a gloomy indicator arsenic startups brace for further macro headwinds and repricing events.

Another circular of cuts are apt aboriginal adjacent year

If the macro situation doesn’t improve, we would expect different question of occupation cuts aft companies’ fourth-quarter committee meetings (usually successful January oregon February).

Many companies volition sermon their CY ’23 forecasts, and headcount is ever a lever to widen runway since it tin relationship for up to 80% of a startup’s expenses. Given that galore companies person maintained their headcounts, we whitethorn spot them having to laic radical disconnected to trim burn.

Tighter hiring started arsenic aboriginal arsenic May 2022

Private companies began tapping the brakes close astir May 2022, and much firms started acting successful unison, arsenic seen from the tighter headcount velocity interquartile range, which was compressed heavy but has present stabilized.

Companies serving HR and procurement saw the steepest drop

As these services person shrunk crossed the industry, companies providing tech aimed astatine HR and procurement professionals saw the steepest driblet successful headcount growth. However, each the tracked lawsuit profiles person trended toward reducing hiring efforts.

There’s tons of disposable talent

On a affirmative note, this is an fantabulous clip for companies with product-market acceptable (and supportive investors) to prosecute the close talent, arsenic large tech is reducing headcount and the marketplace is flooded with exceptional talent.

From assertive headcount maturation to holding flat

Until April, astir companies were hiring aggressively, with headcount rising period implicit period astatine implicit 10%, and the 75th percentile was adjacent to astir 20%.

In contrast, the existent median is +1% and the 75th percentile is +4%.

This downward inclination kicked disconnected successful May and continues today. The interquartile scope continues to compress, with the median yet heading toward level headcount (i.e., replacing earthy attrition but not hiring beyond that). The 25th percentile fell into layoff territory astir August, but some the 10th percentile and 25th percentile person since pulled back.

Image Credits: Eddie Ackerman

Now that we person acceptable the stage:

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·