Carl Niedbala Contributor

Carl Niedbala is COO and co-founder of Founder Shield, a commercialized security broker.

High-growth companies often acceptable important goals, knowing afloat good that the thought of “overnight success” is for the storybooks. However, determination is nary amended clip than the mediate of a marketplace downturn to commencement readying for the leap from a backstage to a nationalist company.

De-risking the way to going nationalist requires strategical planning, which takes time. Companies with goals to spell nationalist successful little than 3 years indispensable truthful program for it present — contempt the downturn — to get the moving commencement they’ll request to navigate the unfastened market.

Let’s research wherefore this adverse system is perfect for readying an IPO and what to bash astir it.

Growth investors person precocious pulled back

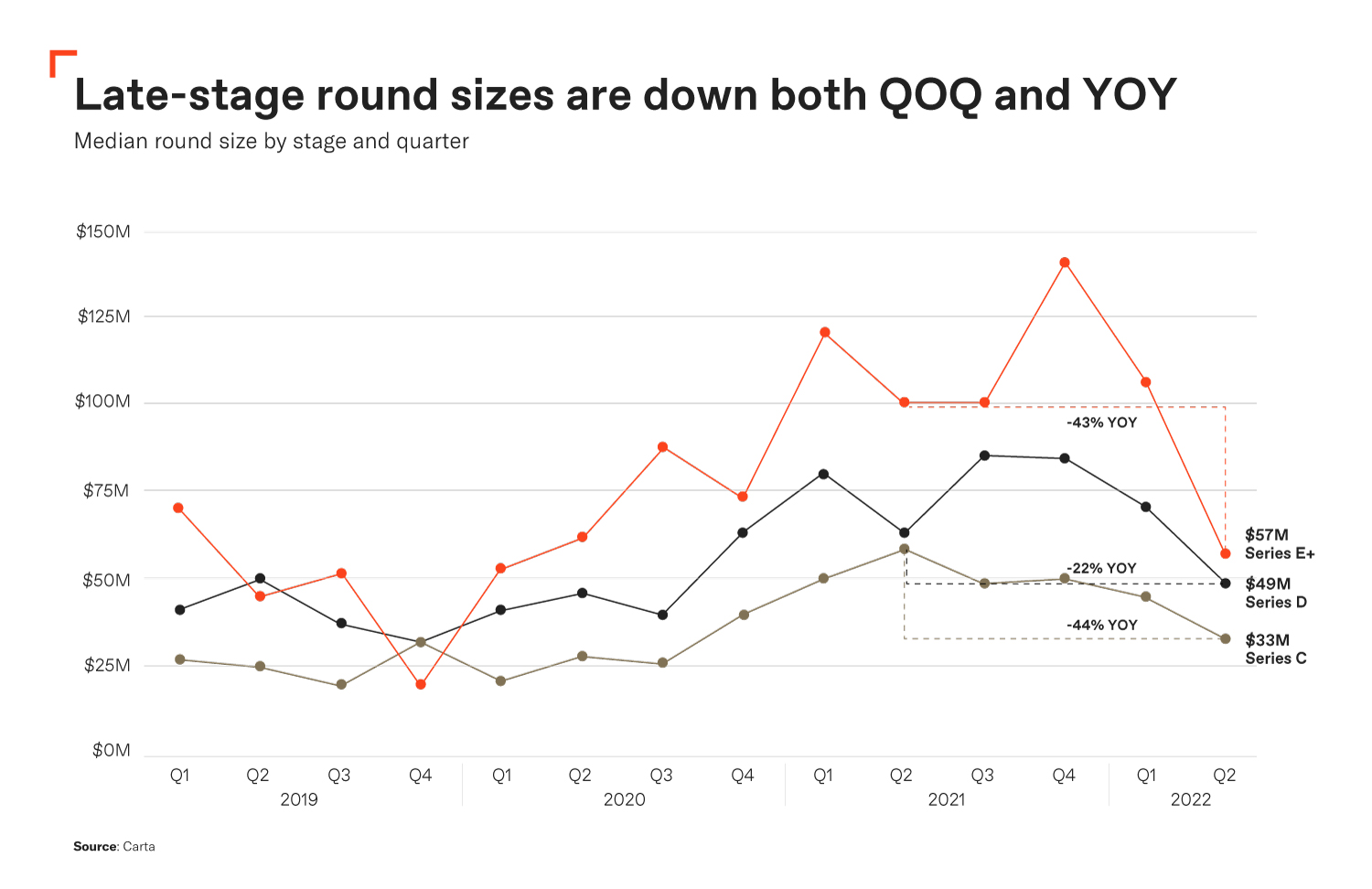

Carta reports that private fundraising levels person declined crossed the U.S. from a record-breaking 2021. Unsurprisingly, late-stage companies person experienced the brunt of this blow.

Market experts are presently encouraging leaders not to pin their hopes connected task superior adust powder, adjacent though there’s plentifulness of it. As the graph beneath indicates, the size of late-stage backing rounds has shrunk.

Image Credits: Founder Shield

Although fewer bask marketplace downturns, however this 1 unfolds tin present insights to late-stage companies that wage attention. On 1 hand, galore leaders are embracing the connection of the Sequoia memo. We tin hold with their ideas to prioritize profits implicit maturation — scaling is antithetic from what it utilized to be, and we indispensable swallow that jagged pill.

On the different hand, cost-cutting and giving up anticipation of fundraising isn’t each doom and gloom. After all, erstwhile determination is wealth to beryllium found, immoderate innovative laminitis volition find it. We spot it each day; lone now, the way looks different.

Market downturns spur valuation corrections

Course-correcting is simply a conception often discussed amid marketplace downturns. The pendulum swings 1 mode for a period, past begins its travel toward a much balanced standard. In this case, the unfastened marketplace thrived connected bloated valuations — most startups were overvalued earlier 2021.

Furthermore, galore stated that 2021 was a occurrence year, particularly arsenic VC concern astir doubled to $643 billion. The U.S. sprouted much than 580 caller unicorns and saw implicit 1,030 IPOs (over fractional were SPACs), importantly higher than the twelvemonth before. This twelvemonth has lone welcomed astir 170 nationalist listings.

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·