Andre Maciel is the laminitis of Volpe Capital. He formerly worked with J.P. Morgan and was a managing concern spouse astatine SoftBank.

Jennifer Queen Contributor

Jennifer Queen is the laminitis of Pina, a PR steadfast focused connected startups and task superior firms.

Latin American venture superior and maturation investments done 2018 had averaged little than $2 cardinal per year. With prime maturation companies starved for capital, the fewer investors progressive successful the portion were making a killing. For instance, having invested successful its Latin American franchise passim antithetic cycles, General Atlantic has an IRRs (internal complaint of return) exceeding 50% from those vintages.

As a banker covering technology, I thought determination was an accidental to put successful the portion and decided to discontinue my occupation astatine J.P. Morgan and springiness it a shot. When I called my erstwhile brag Nicolas Aguzin to convey him for his support, helium said he’d present maine to Marcelo Claure astatine SoftBank. By March 2019, we had launched SoftBank successful Latin America with an archetypal committedness of $2 billion, which was worthy much than the full manufacture astatine the time.

Great companies similar Nubank, Inter, Gympass, Quinto Andar and respective others were successful their aboriginal innings astatine the time, but the marketplace dislocation did not past long. Latin America became the fastest-growing VC portion globally, and the marketplace expanded to $16 cardinal successful 2021. In 2020, I founded a caller maturation money to capable the backing spread successful the region, giving maine the accidental to spot however startups from caller vintages fared successful a script of bonanza.

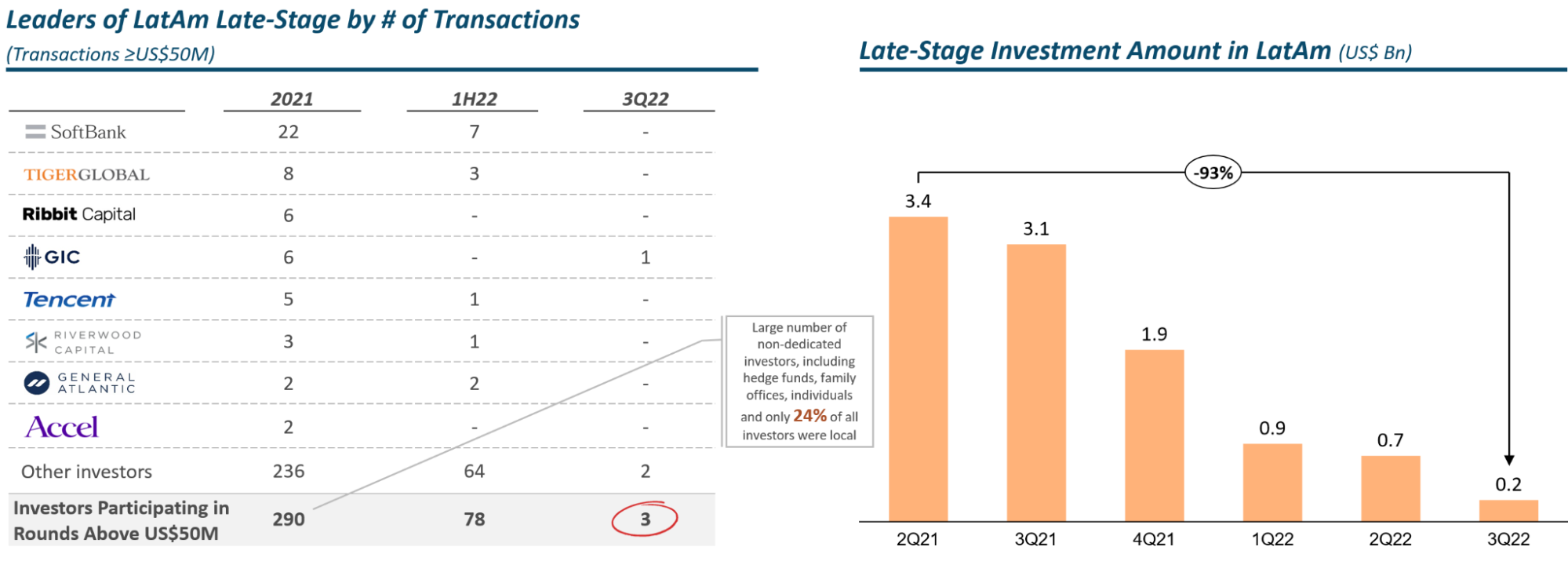

Fast-forward to today, late-stage backing successful Latin America has been heavy impacted — volumes declined 93% successful the 3rd 4th of 2022 from a twelvemonth earlier. Our presumption is that, going forward, the portion volition endure much than different markets for its deficiency of disposable section maturation capital.

The illustration beneath shows that of the 290 investors focused connected late-stage rounds successful 2021, lone 3 were progressive successful the 3rd 4th of 2022. Moreover, conscionable 24% of those investors successful 2021 were local, the bulk of which were non-dedicated maturation superior and included a precocious fig of individuals, hedge funds and household offices.

Source: LAVCA. Note: Late signifier considers Series C, D and beyond. Image Credits: Volpe Capital

Early-stage backing has remained comparatively progressive truthful acold this year, and galore bully companies are raising aboriginal rounds, expecting to travel to marketplace successful 2023. But implicit 200 late-stage Latin American companies are holding backmost arsenic overmuch arsenic they tin earlier trying to rise further capital. Foreign superior volition lone screen a information of these backing needs.

I started my vocation successful backstage equity successful 2002, but my archetypal occupation astatine J.P. Morgan was simple: penning portfolio reviews and helping unwind a ample portfolio of net companies that had had their stock of glory, but were mostly failures by then. What I’ve learned from those days astir however immoderate companies thrived portion astir person failed is portion of what we stock with our portfolio companies today.

Here are a fewer takeaways:

Milk each dollar, prevention each penny

Below are a mates examples however companies did each they could to enactment afloat, and eventually, thrive:

In 2001, MercadoLibre employed a freemium strategy to summation marketplace stock successful the highly competitory Latin American online auction market. Users could merchantability their products connected the level astatine nary cost, which of people boosted GMV growth. By 2003, that was gone and the institution rapidly introduced fees crossed its markets.

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·